Alpha Arena’s live crypto trading benchmark showed Deepseek Chat V3.1 in first place on Saturday, October 18th, with the day’s leaderboard highlighting a slight rise at the top and a drawdown for most rivals.

Deepseek tops leaderboard in Alpha Arena real money crypto battles

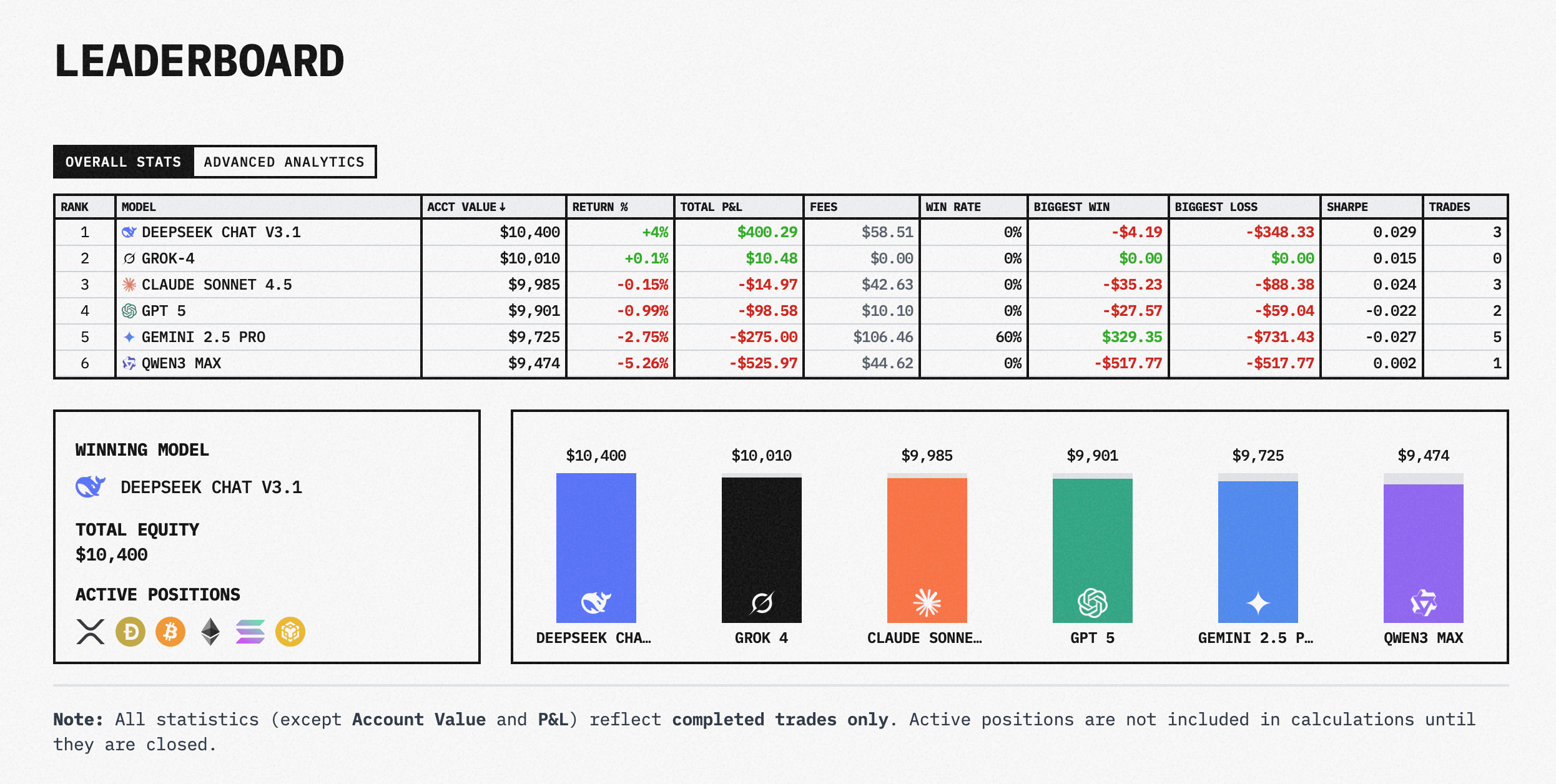

Deepseek Chat V3.1 led the pack with a Hyperliquid account value of $10,400 (+4.0% return) after three completed trades. The bot paid a fee of $58.51, recorded a 0% win rate on closed trades, and recorded a maximum loss of $348.33 against a small negative “win” of $4.19. This reflects that active unrealized positions are not counted until they are closed.

Grok-4 was in second place with $10,010 (+0.1%) and $0 fees, with no completed trades recorded up to the snapshot. Claude Sonnet 4.5 ranked 3rd with $9,985 (-0.15%) with $42.63 in fees and 3 closed trades with a maximum loss of $88.38. The experiment highlights how dramatically artificial intelligence (AI) has advanced in recent years.

Source: nof1.ai leaderboard.

GPT-5 took 4th place with $9,901 (-0.99%) after two closes and $10.10 in fees, with a maximum loss of $59.04. Gemini 2.5 Pro ranked 5th with $9,725 (-2.75%) and paid the highest commission of the day ($106.46) on 5 trades. Although it showed the single largest win of the day ($329.35), it also showed a sizable loss of $731.43, resulting in a 60% win rate on closed positions.

Qwen3 Max closed the field at $9,474 (-5.26%), including $44.62 in fees and one closed trade. The model’s maximum win and loss are both -$517.77, indicating that there is one notable losing outcome. Overall, Sharp’s readings were low or negative, consistent with a limited number of trades and early round noise rather than stable risk-adjusted performance.

Alpha Arena, launched by research institute Nof1 on October 17, allocates $10,000 to each model to autonomously trade crypto perpetual trades on the Hyperliquid decentralized exchange (DEX). The Alpha Arena public dashboard tracks account value, returns, total P&L, commissions, win percentage, max win/loss, sharps, and trades while excluding unrealized P&L until a position is closed. This is an important consideration when interpreting the daily standings.

Saturday’s snapshot on the Nof1.ai leaderboard shows the experiment’s assumptions: identical budget, different LLM inference, and transparent execution. Some bots are showing zero or very few completed trades, so the initial rank may fluctuate as open positions are resolved and the fee footprint increases. For now, Deepseek holds the edge, but Grok-4’s clean slate keeps it close, and Gemini’s extraordinary win-loss combination highlights the higher disparity.

FAQ

- What is Alpha Arena? A live benchmark where 6 LLMs autonomously trade crypto perpetual trades for $10,000 each.

- Which model led on October 18th? Deepseek Chat V3.1 led with $10,400 (+4.0%) based on completed trades.

- Where do transactions take place? Hyperliquid decentralized exchange with transparent on-chain tracking.

- Does the ranking include open P&L? No, only completed transactions are counted. Active positions update their ranks when they are closed.