According to Animoca, tokenized real-world assets could ultimately represent trillions of dollars worth of traditional financial assets in the future of multichine.

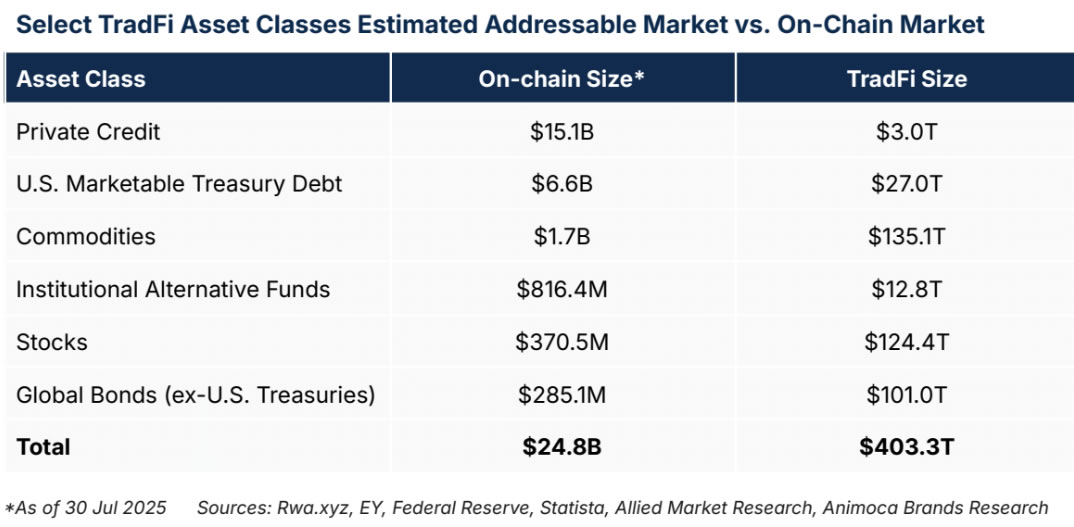

“The estimated $400 trillion addressable Tradfi market highlights the potential growth runways for RWA tokenization,” researchers Andrew Ho and Ming Ruan said in an August research paper for Web3 digital property company Animoca brand.

Researchers have found that the tokenized real-world assets (RWA) sector is currently a small percentage of the total addressable market ($26 billion), exceeding $400 trillion.

These asset classes include private credit, Treasury debt, commodities, equities, alternative funds and global debt.

Now there is a “strategic race to build a full stack integrated platform” with large asset managers, and long-term value arises for those who “can control the lifecycle of their asset.”

The TRADFI addressable asset market is 16,000 times larger than the current on-chain market. Source: Animoca.

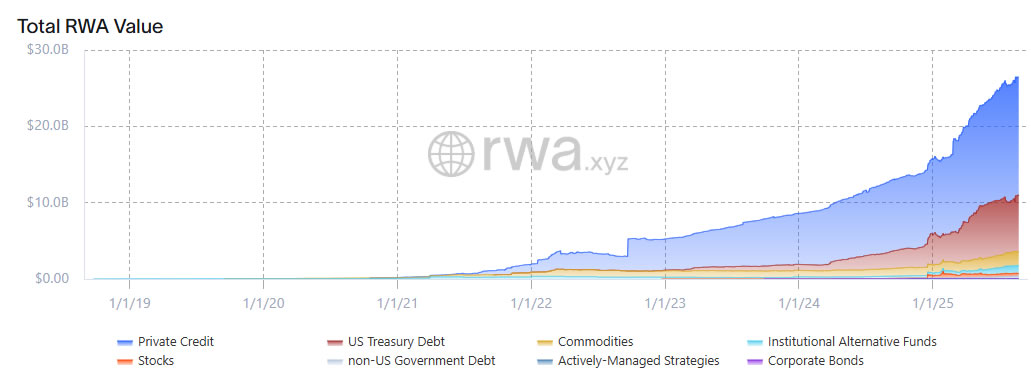

RWA Value is the best hit ever

According to industry tracker RWA.xyz, the emerging RWA tokenization market is currently at an all-time high of $26.5 billion, an up 70% increase since the beginning of the year.

This is “a clear momentum and increased institutional confidence,” the researchers said.

Total RWA value at ATH. sauce: rwa.xyz

The current RWA landscape is dominated by two categories: Private Credit and the US Treasury, and together, accounts for almost 90% of the tokenized market value.

Related: TVL is over $1 billion as centrifuged facilities drive the tokenized RWA boom: CEO

RWA Future is not only Ethereum, but also multi-chine.

Ethereum is the market leader in RWA tokenization with a 55% market share, including Stablecoins, and an on-chain value of $156 billion.

According to RWA.xyz, if it includes Ethereum Layer-2 networks such as Zksync Era, Polygon, and Arbitrum, its share increases to 76%.

“Its primary position comes from its security, liquidity and its biggest ecosystem of developers and Defi applications,” the researcher said.

Growth in RWA tokenization could drive further demand for related crypto assets such as Ether (ETH) and Oracle Provider ChainLink (Link), which hit an all-time high on Sunday.

However, researchers said the RWA tokenization activities are “distributed across the multichine ecosystem, including public and private blockchains,” adding that Ethereum’s current lead is “challenged by high performance and dedicated networks, indicating that interoperability is key to success.”

Animoca Brands launched its own tokenized RWA market earlier this month, known as Nuva.

magazine: eth ‘god candle,’ $6k Next? Coinbase enhances security: Hodler’s Digest