Just 24 hours after its debut, Hyperliquid’s Stock Perpetual Trading (Stock Purp) generated nearly $100 million in trading volume. Despite this success, open interest was capped at $66 million.

This launch has sparked intense debate across the crypto and DeFi communities, with many wondering whether this is a “great opportunity” for an on-chain market for equity investments. Others wonder if this is just a high-stakes experiment built on weak assumptions.

New opportunities: 24/7 liquidity and the evolution of zero-day options

Hyperliquid’s impressive launch of its perpetual equity product has sparked debate in the investment community. What sets Equity Expert apart is its ability to transform traditional stock markets into a complete 24/7 on-chain trading ecosystem.

Unlike traditional stock exchanges, which only operate for a few hours a day, on-chain equity derivatives enable continuous, borderless and transparent trading, in line with DeFi’s ethos of open, permissionless markets.

Super liquid stock market. Source: Hyper Liquid

Analysts argue that equity PERPs are not intended to replace traditional stock futures, but rather to disrupt zero-day options (0DTEs), a product favored by short-term speculators seeking leverage. As Carbyonzio explained, stock criminals “don’t replace stock futures; they replace zero-day options.”

This change is consistent with a widespread desire for leverage in modern markets. José María Macedo noted that Robinhood earns nearly $1 billion a year from options trading alone, or about 25% of its total revenue, indicating a huge demand for leveraged exposure. Equity criminals could potentially fill this gap on-chain and provide a simpler, more decentralized alternative.

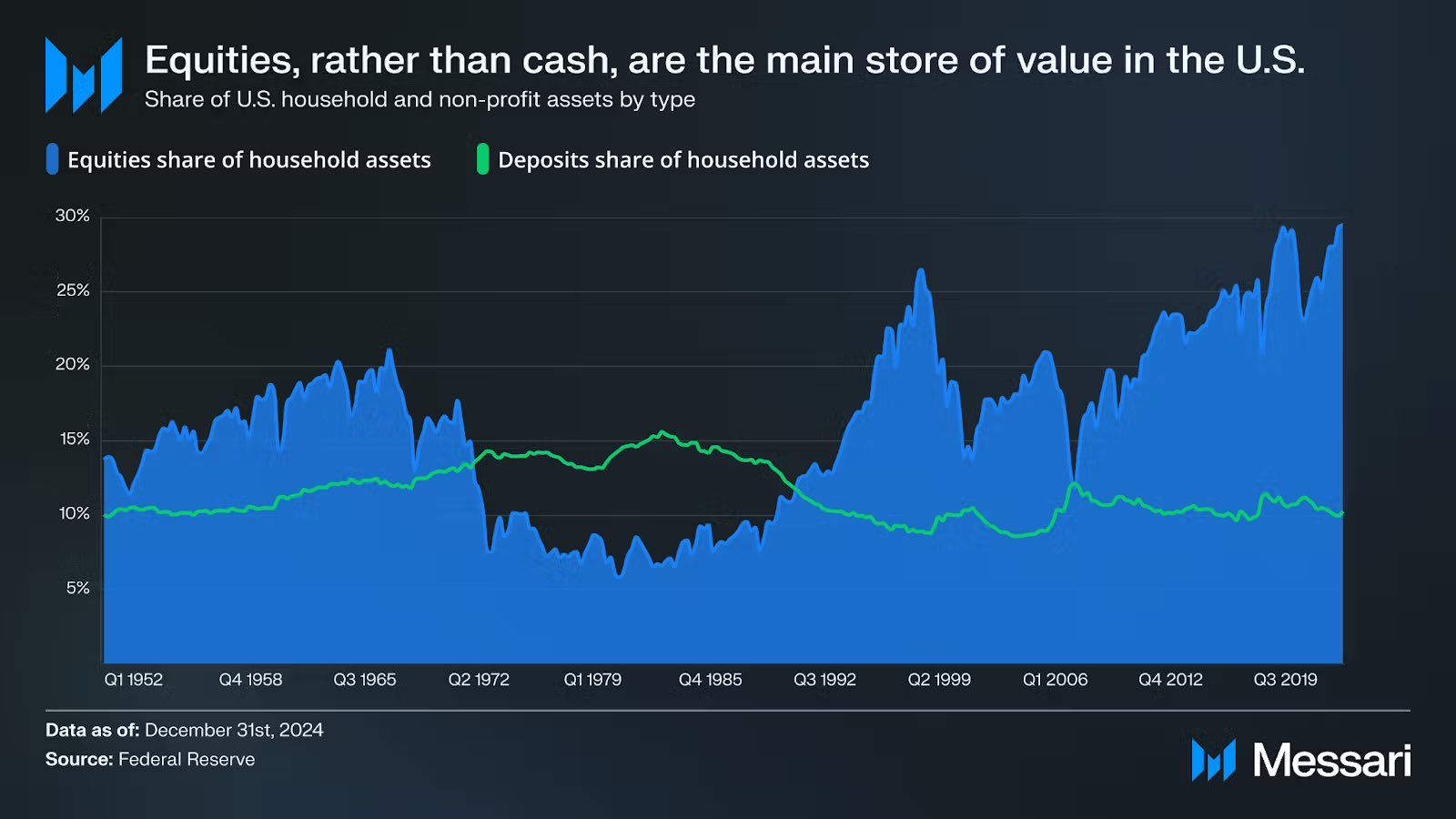

Some industry observers even believe that stock crime could rival crypto crime and stablecoins in scale. Ryan Watkins predicts that global equity investing will be the most important growth opportunity for cryptocurrencies over the next 12-18 months, potentially outpacing stablecoins. Dylan G. Bain echoes this view, suggesting that equity PERP Total Addressable Market (TAM) could eventually “outperform stablecoins” once mainstream adoption begins.

Stock share. Source: Dylan G. Bain

Risks and realities: legal gaps and market depth

Despite the excitement, several prominent voices are sounding the alarm. DCinvestor criticized perpetual contracts as inherently biased and warned that exchanges often have visibility into a trader’s liquidation point, allowing for “liquidation hunting” in illiquid environments. Such dynamics can be even more problematic in early-stage on-chain stock markets, where liquidity and volatility are shallow.

“Purps is effectively a game of match-fixing. Even if there is no actual match-fixing, unless you have extreme risk management and portfolio management skills, the rules are virtually guaranteed to eventually lead to you losing and losing money,” he wrote.

Furthermore, stocks are fundamentally different from cryptocurrencies. Stocks come with dividends, shareholder rights, and legal protections, none of which translate well to decentralized derivatives. One analyst warned that separating stocks from their legal framework could be at odds with long-term investment interests, while Sam warned that current hiring expectations were “much higher than reality”.

“The stock crisis could be a defining moment for Hyperliquid. However, the path to adoption is uncertain and today’s expectations are much higher than reality,” Sam pointed out.

The main operational challenges lie in creating a transparent risk management system, clearing protection and regulatory alignment. Without these safeguards, similar to “circuit breakers” on traditional exchanges, on-chain equity personnel could soon face skepticism and increased scrutiny from regulators around the world.

In summary, on-chain equity PERP is a strategic innovation with immense potential that bridges the gap between traditional finance and decentralized trading. The appeal of 24/7 liquidity, high leverage demands, and globally accessible infrastructure is undeniable. But success first depends on solving difficult problems such as liquidity, transparency, compliance, and investor protection.

The post 24/7 On-Chain Stocks? Hyperliquid’s Equity Perps Ignite a DeFi Frenzy appeared first on BeInCrypto.