important notes

- Analysts Bull Theory and Zero Hedge highlighted Bitcoin’s upside and downside swings between $3,000 and $5,000 as part of their “10am operation” theory.

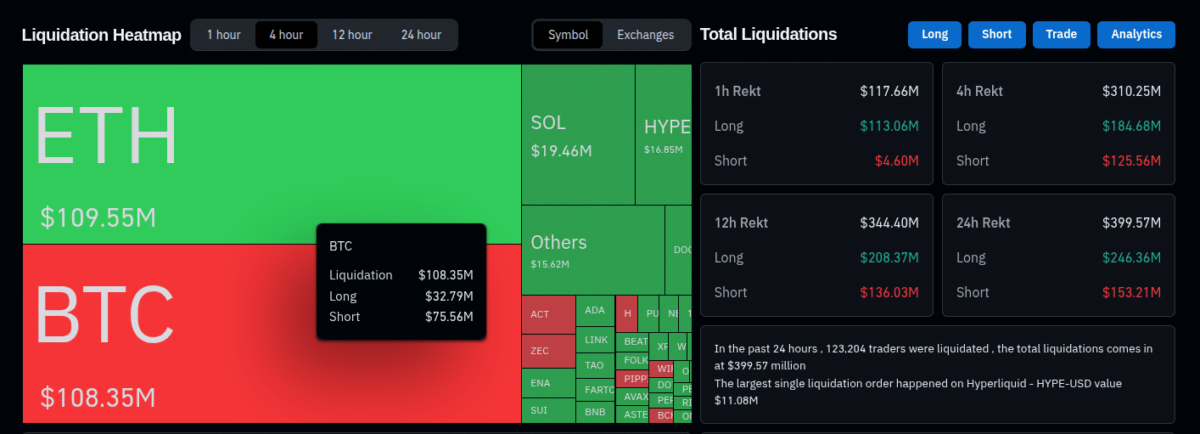

- The liquidation amount of all cryptocurrencies reached up to $310 million in four hours, with short liquidations for BTC and long liquidations for ETH.

- Bitcoin traded as low as $87,100 and as high as $90,300 during the two most volatile hours of the day.

On December 17th, Bitcoin experienced a two-hour period of highly volatile ups and downs, with an aggressive pump liquidating both short and long positions, followed by an aggressive fire sale, moving the respective BTC prices around $3,000.

Bull Theory posted about this move and highlighted the $3,300 Bitcoin BTC 86 398 dollars 24 hour volatility: 1.5% Market capitalization: $1.73 trillion Vol. 24 hours: $46.60B A $106 million short position was eliminated in 30 minutes, resulting in a short squeeze event. The leading cryptocurrency then returned all those gains with a $3,400 fire sale over the next 45 minutes, liquidating $52 million worth of long positions and recording a long squeeze event, according to analysts.

“An insane level of manipulation in cryptocurrencies,” Bull Theory concluded.

🚨BREAKING: Bitcoin raised $3,300 in just 30 minutes, liquidating $106 million worth of shorts.

However, over the next 45 minutes, he released $3,400, liquidating $52 million worth of longs.

Insane levels of manipulation in cryptocurrencies. pic.twitter.com/5zrlnsIhgj

— Bull Theory (@Bull Theoryio) December 17, 2025

Other analysts noticed the same movement, reported at different moments, and covered different perspectives of the same event. DEGEN NEWS described this as Bitcoin recording “two consecutive volatile candlesticks in one hour,” while Zero Hedge doubled down on the “10am slam algo” theory, describing the event as “$5,000 price movement in the past hour” in its own post.

Related article: Bitcoin ETF loses another $277 million due to selling by long-term holders

As Coinspeaker reported on December 12th, both zerohedge and Bull Theory have previously commented on what appears to be planned market manipulation occurring at 10am EST when US markets open.

Bitcoin price analysis and $100 million liquidation

Overall, this recent swing has resulted in more than 120,000 traders liquidating nearly $400 million in the past 24 hours. More than $340 million of this was generated in the last 12 hours alone, and more than $310 million in the last four hours of this writing. This is consistent with pump and dump events reported by multiple sources.

Looking at Bitcoin, the leading cryptocurrency, $108 million was liquidated in four hours, according to data from CoinGlass. According to CoinGlass, $75 million was generated from short positions and $32 million from long positions. Ethereum Ethereum $2,847 24 hour volatility: 3.3% Market capitalization: $34.375 billion Vol. 24 hours: $2.434 billion We settled similar totals, but the long squeeze side prevailed.

Liquidation heat map and total liquidation amount as of December 17th | Source: Coinglass

On TradingView’s indexed Bitcoin price chart, you can see the pump and dump from 9am to 11am ET on two hourly candlesticks. The move started at $87,100, rose to $90,300, and returned to $87,200.

Bitcoin price chart |Source: TradingView

Bitcoin is currently trading at $86,600, down 1.35% during the day. Meanwhile, CoinSpeaker reported that the Spot Bitcoin ETF, led by BlackRock’s IBIT, recorded net outflows of $277 million on December 16, revealing how Wall Street players are positioning themselves around Bitcoin.

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.